ICT Guidance on GHG Protocol Product Life Cycle Accounting and Reporting Standard

If the amount is negative, it means that the company had incurred a loss and if the amount is positive, it means that the company had earned a significant profit within the specific time period. Your accounting type and method determine when you identify expenses and income. For accrual accounting, you’ll identify financial transactions when they are incurred. Meanwhile, cash accounting involves looking for transactions whenever cash changes hands. The accounting cycle is a set of steps that are repeated in the same order every period.

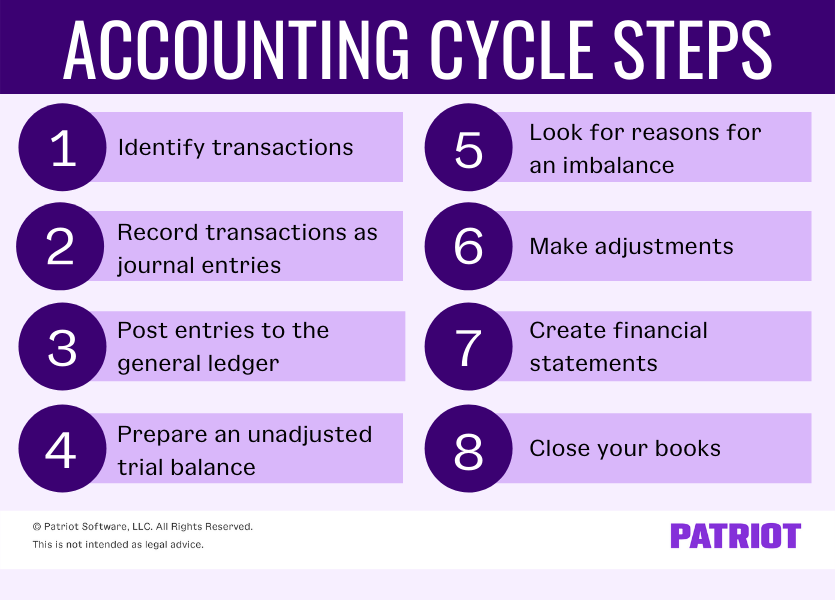

What are the eight steps of the accounting cycle?

Tax adjustments happen once a year, and your CPA will likely lead you through it. Not sure where to start or which accounting service fits your needs? Our team is ready to learn about your business and guide you to the right solution. He’s a co-founder of Best Writing, an all-in-one platform connecting writers with businesses.

Steps in The Accounting Cycle

- The accounting cycle periods a business chooses tend to reflect the size of the company.

- This process is repeated for all revenue and expense ledger accounts.

- There are many essential parts of your business’s operations and keeping accurate financial records is fundamental among them.

- You pull all the information from the previous steps in the accounting cycle and plug them into a financial statement template.

- Essentially, the accounting cycle represents a carefully orchestrated series of steps that converts raw financial data into meaningful and comprehensible reports.

If a small business or one-person shop is involved, the owner may handle the tasks, or outsource the work to an accounting firm. The purpose of this step is to ensure that the total credit balance and total debit balance are equal. This stage can catch a lot of mistakes if those numbers do not match up. Depending on each company’s system, more or less technical automation may be utilized.

Post Closing Journal Entries To Close the Books

It is a complete process where an accountant or the bookkeeper performs accounting tasks. The accounting cycle helps produce helpful information for external users, such as stakeholders and investors, while the budget cycle is used specifically for internal management. This article delves into the nuances of these steps and highlights its significance in promoting transparency, accountability, and well-informed decision-making in the business sphere.

Step 8: Close the Books

The accounting cycle involves all of the financial transactions for a business. It refers to recording these transactions, as well as processing them. This includes when a financial transaction occurs, all the way to the creation of financial statements.

Ray prints out his trial balance and quickly scans the ending balance for each account, looking for any irregularities or unexpected balances. For example, Ray notices a large ending balance in prepaid rent when he knows he hasn’t yet paid rent for the coming month. He investigates and realizes he forgot to make an adjusting journal entry to move last month’s rent from prepaid expenses to rent expense. This step occurs in the second half of xero guide to corporation tax after the period ends and you’ve already identified, recorded, and posted your transactions. During the sorting process, you organize transactions into accounts in an accounting ledger. Those accounts are categorized into assets, liabilities, revenues, expenses, and equity.

If you’re looking for any financial record for your business, the fastest way is to check the ledger. In short, an accounting cycle makes sure that all of the money passing through your business is actually “accounted” for. Without them, you wouldn’t be able to do things like plan expenses, secure loans, or sell your business. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support.

To fully understand the accounting cycle, it’s important to have a solid understanding of the basic accounting principles. You need to know about revenue recognition (when a company can record sales revenue), the matching principle (matching expenses to revenues), and the accrual principle. The first step of the accounting cycle is to analyze each transaction as it occurs in the business.

From identifying transactions to preparing financial statements, the 8 steps in the accounting cycle ensure accurate record-keeping. The accounting cycle is a collective process of identifying, analyzing, and recording the accounting events of a company. It is a standard 8-step process that begins when a transaction occurs and ends with its inclusion in the financial statements and the closing of the books. This final trial balance is generally referred to as the post-closing trial balance. Its format is similar to that of an unadjusted and adjusted trial balance.

Commenti recenti