4 7: Closing Entries Business LibreTexts

This time period, called the accounting period, usually reflects one fiscal year. However, your business is also free to handle closing entries monthly, quarterly, or every six months. An accounting period is any duration of time that’s covered by financial statements. It can be a calendar year for one business while another business might use a fiscal quarter.

Close all dividend or withdrawal accounts

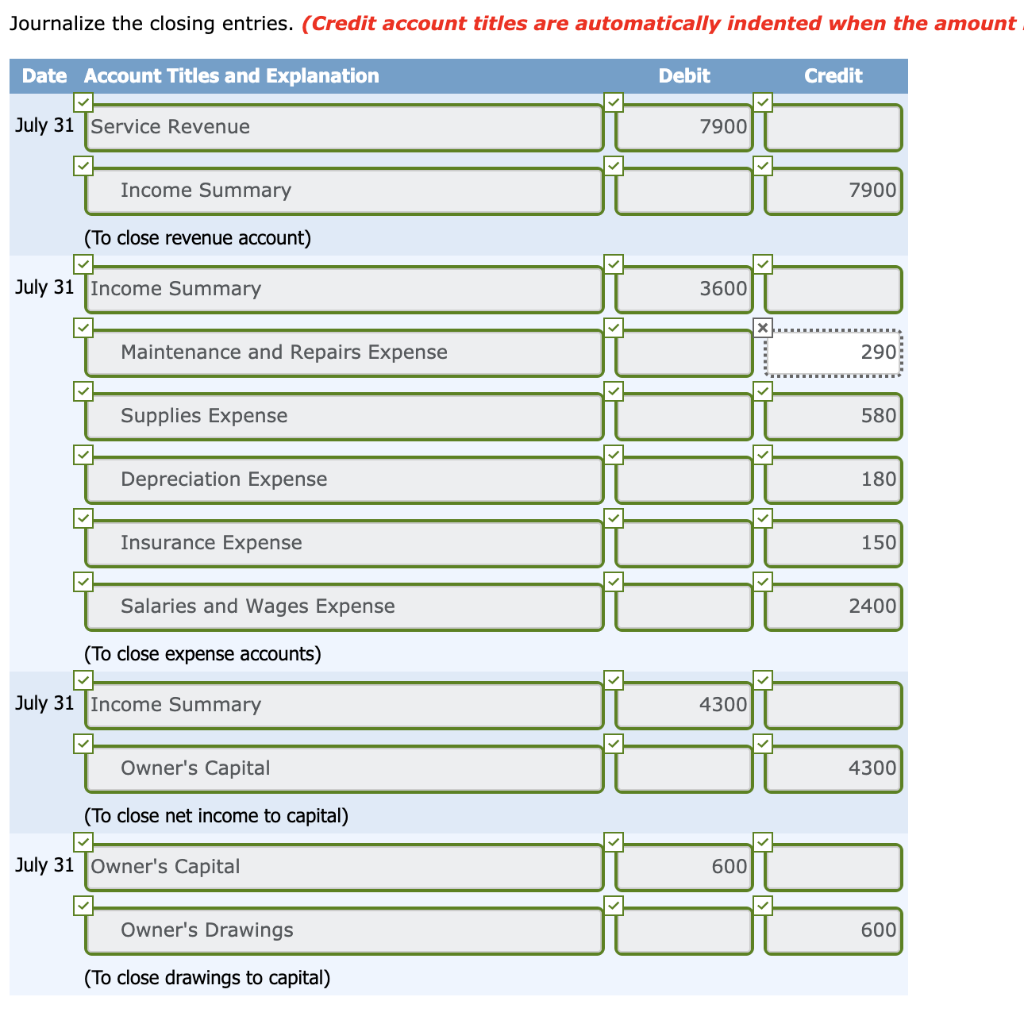

Accounts are considered “temporary” when they only accumulate transactions over one single accounting period. Temporary accounts are closed or zero-ed out so that their balances don’t get mixed up with those of the next year. All of Paul’s revenue or income accounts are debited and credited to the income summary account. This resets the income accounts to zero and prepares them for the next year. Temporary accounts can either be closed directly to the retained earnings account or to an intermediate account called the income summary account. The income summary account is then closed to the retained earnings account.

What is the approximate value of your cash savings and other investments?

We could do this, but by having the Income Summaryaccount, you get a balance for net income a second time. This givesyou the balance to compare to the income statement, and allows youto double check that all income statement accounts are closed andhave correct amounts. If you put the revenues and expenses directlyinto retained earnings, you will not see that check figure. Nomatter which way you choose to close, the same final balance is inretained earnings. In summary, permanent accounts hold balances that persist from one period to another.

Step 1: Clear revenue to the income summary account

At the core of this suite is the Financial Close Management solution, which simplifies and accelerates financial close activities, ensuring compliance and reducing errors. Closing entries are the journal entries used at the end of an accounting period. Do you want to learn more about debit, credit entries, and how to record your journal entries properly? Then, head over to our guide on journalizing transactions, with definitions and examples for business.

Lastly, if we’re dealing with a company that distributes dividends, we have to transfer these dividends directly to retained earnings. For partnerships, each partners’ capital account will be credited based on the agreement of the partnership (for example, 50% to Partner A, 30% to B, and 20% to C). For corporations, Income Summary is closed entirely to “Retained Earnings”. Notice that the balance of the Income Summary account is actually the net income for the period. Remember that net income is equal to all income minus all expenses. Let’s also assume that ABC Ltd incurred expenses of ₹ 45,00,000 in the raw material purchase, machinery purchase, salary paid to its employees, etc., over the accounting year 2018.

Step 3: Close Income Summary account

In this chapter, we complete the final steps (steps 8 and 9) ofthe accounting cycle, the closing process. This is an optional stepin the accounting cycle that you will learn about in futurecourses. Steps 1 through 4 were covered in Analyzing and Recording Transactions and Steps 5 through 7were covered in The Adjustment Process. Manually creating your closing entries can be a tiresome and time-consuming process. And unless you’re extremely knowledgeable in how the accounting cycle works, it’s likely you’ll make a few accounting errors along the way.

- Only incomestatement accounts help us summarize income, so only incomestatement accounts should go into income summary.

- Therefore,these accounts still have a balance in the new year, because theyare not closed, and the balances are carried forward from December31 to January 1 to start the new annual accounting period.

- The main purpose of these closing entries is to bring the temporary journal account balances to zero for the next accounting period, which keeps the accounts reconciled.

- Notice that the balances in the expense accounts are now zeroand are ready to accumulate expenses in the next period.

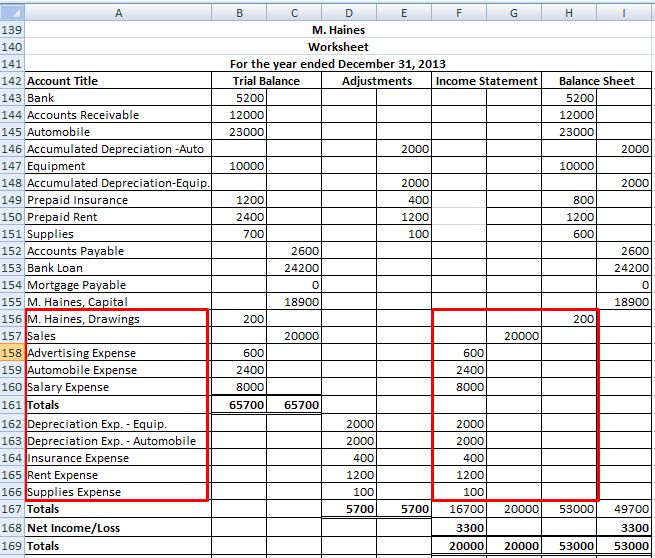

Our discussion here begins with journalizing and posting theclosing entries (Figure5.2). These posted entries will then translate into apost-closing trial balance, which is a trialbalance that is prepared after all of the closing entries have beenrecorded. Closing entries are put into action on the last day of an accounting period. There are various journals for example cash journal, sales journal, purchase journal etc., which allow users to record transactions and find out what caused changes in the existing balances. Closing entries are mainly used to determine the financial position of a company at the end of a specific accounting period. Closing entries are mainly made to update the Retained Earnings to reflect the results of operations and to eliminate the balances in the revenue and expense accounts, enabling them to be used again in a subsequent period.

Otherwise, the balances in these accounts would be incorrectly included in the totals for the following reporting period. A temporary account is an income statement account, dividend account or drawings account. It is temporary because it lasts only for the accounting period. At the end of the accounting period, the balance is transferred to the retained earnings account, and the account is closed with a zero balance. For each temporary account there will be a closing journal entry. So for posting the how to prepare a cash flow statement model that balances in the general ledger, the balances from revenue and expense account will be moved to the income summary account.

Now for this step, we need to get the balance of the Income Summary account. In step 1, we credited it for $9,850 and debited it in step 2 for $8,790. Any remaining balances will now be transferred and a post-closing trial balance will be reviewed. These accounts are be zeroed and their balance should be transferred to permanent accounts. The net balance of the income summary account would be the net profit or net loss incurred during the period. ABC Ltd. earned ₹ 1,00,00,000 from sales revenue over the year 2018 so the revenue account has been credited throughout the year.

The income summary account serves as a temporary account used only during the closing process. It contains all the company’s revenues and expenses for the current accounting time period. In other words, it contains net income or the earnings figure that remains after subtracting all business expenses, depreciation, debt service expense, and taxes. The income summary account doesn’t factor in when preparing financial statements because its only purpose is to be used during the closing process.

Commenti recenti