10 8: Using Variance Analysis with Activity-Based Costing Business LibreTexts

The direct labor efficiency and rate variances are used to determine if the overall direct labor variance is an efficiency issue, rate issue, or both. The total amounts for direct materials actually purchased and used are reported on the following line. The actual quantity purchased and used to produce 150,000 units was 600,000 feet of flat nylon cord costing $330,000. The actual price of $0.55 per unit is not given in the actual data presented in Exhibit 8-1. However, it can be calculated by taking the total purchase price and dividing it by the total number of feet purchased. At the beginning of the period, Brad projected that the standard cost to produce one unit should be $7.35.

Labor Cost Variance

- When discussing variable manufacturing overhead, price is referred to as rate, and quantity is referred to as efficiency.

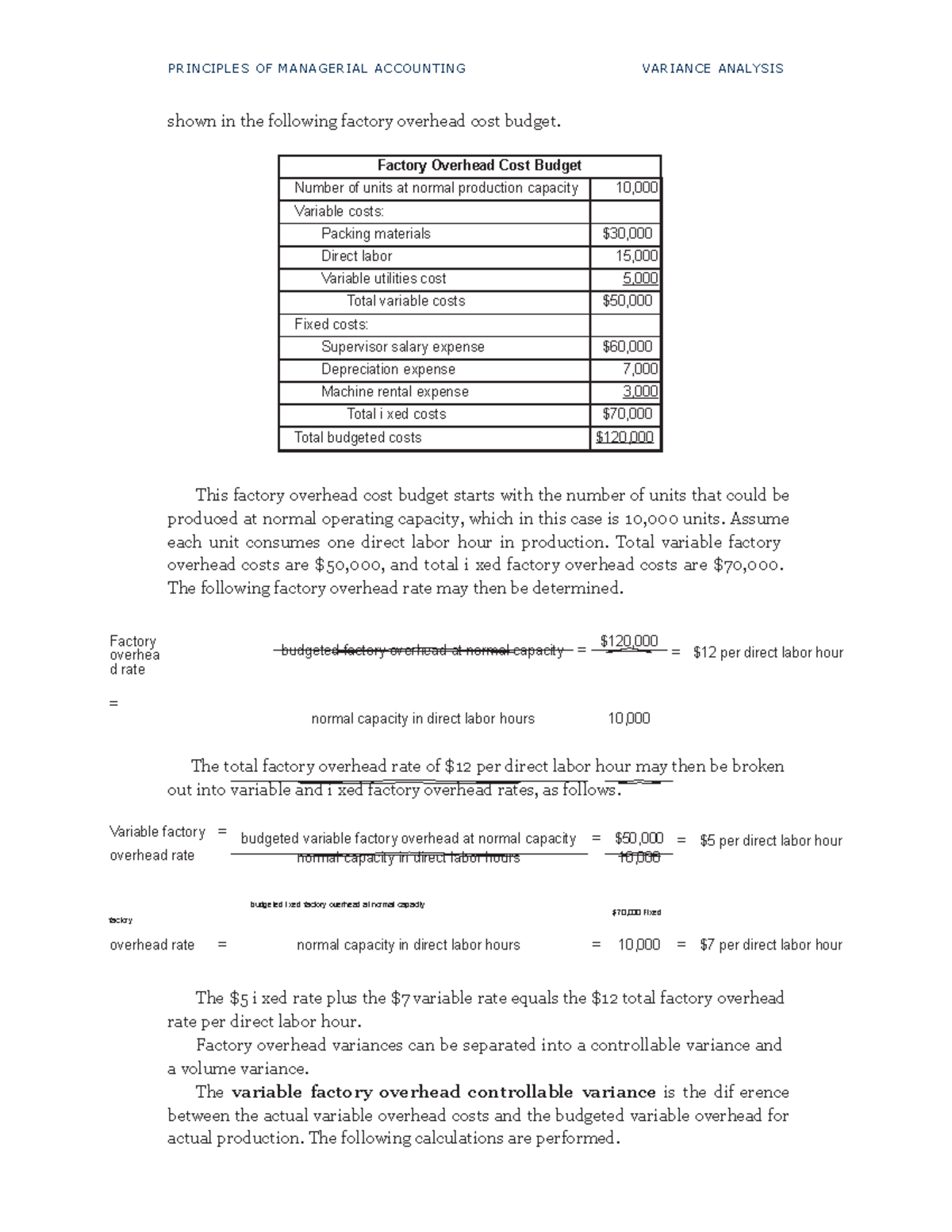

- To begin, recall that overhead has both variable and fixed components (unlike direct labor and direct material that are exclusively variable in nature).

- Notice that this differs from the budgeted fixed overhead by $10,800, representing an unfavorable Fixed Overhead Volume Variance.

- Each unit should require 0.25 direct labor hours to assemble at an average rate of $18 per hour for total direct labor costs of $4.50 per unit.

- It documents where things are going well and, more importantly, where they need improvement.

In this hypothetical example, the overhead variance is -$2,000, indicating an unfavorable situation. This means the actual overhead cost was $2,000 higher than the expected overhead cost based on the standard rate and direct labor hours. An unfavorable variance suggests that the actual overhead cost exceeded the expected overhead cost, given the standard rate and actual direct labor hours. Recall that the standard cost of a product includes not only materials and labor but also variable and fixed overhead. It is likely that the amounts determined for standard overhead costs will differ from what actually occurs.

The Role of Standards in Variance Analysis

As shown in Table 8.1, standard costs have pros and cons to consider when using them in the decision-making and evaluation processes. This chapter defines and discusses the important concepts of standard costing. It also takes a look at the different variances and walks us through how to compute and analyze each variance.

4: Compute and Evaluate Overhead Variances

Although the new fabricator was less experienced, her pay rate per hour was lower. Since she paid less for the material and labor, Patty assumed that at the end of the period overall manufacturing costs would be lower than projected. However, manufacturing costs were higher than expected at the end of the period. Accordingly, Patty decided to perform a standard cost variance analysis on the variable manufacturing costs. A template to compute the standard cost variances related to direct material, direct labor, and variable manufacturing overhead is presented in Exhibit 8-11.

This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead reduction. Sometimes these flexible budget figures and overhead rates differ from the actual results, which produces a variance. The direct labor variances for NoTuggins are presented in Exhibit 8-7 below. Variance Analysis is very important as it helps the management of an entity to control its operational performance and control direct material, direct labor, and many other resources. The sales variance is unfavorable because they generated $1,200 less in revenue than budgeted due to lower sales volume and selling price. The labor variance is unfavorable because they spent $1,500 more on labor than budgeted.

The Column Method for Variance Analysis

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Variance analysis helps managers focus on possible causes of problems and improve performance. It documents where things are going well and, more importantly, where they need improvement.

During the period, 45,000 direct labor hours were actually worked and actual variable manufacturing overhead of $121,500 was incurred. As shown in Exbibit 8-1, Brad projects that the standard variable cost to make one unit of product is $7.35. He estimates that each unit should require 4.2 feet of flat nylon cord that costs $0.50 per foot for total direct material costs per unit of $2.10. Each unit should require 0.25 direct labor hours to assemble at an average rate of $18 per hour for total direct labor costs of $4.50 per unit. Variable manufacturing overhead costs are applied to the product based on direct labor hours. The standard variable manufacturing overhead rate is $3 per direct labor hour.

Actual manufacturing data are collected after the period under consideration is finished. Actual data includes the exact number of units produced during the period and the actual costs incurred. The actual costs and quantities incurred for direct materials, direct labor, and variable manufacturing overhead are reported in Exhibit 8-1. Since variable overhead is consumed at the presumed rate of $10 per hour, this means that $125,000 of variable overhead (actual hours X standard rate) was attributable to the output achieved. Comparing this figure ($125,000) to the standard cost ($102,000) reveals an unfavorable variable overhead efficiency variance of $23,000.

However, the variable standard cost per unit is the same per unit for each level of production, but the total variable costs will change. In a standard cost system, overhead is applied to the goods based on a standard overhead rate. The standard overhead rate is calculated by dividing budgeted overhead at a given level of production (known as normal capacity) by the level of activity required for that particular level of production.

The following is a summary of all direct materials variances (Figure 8.6), direct labor variances (Figure 8.7), and overhead variances (Figure 8.8) presented as both formulas and tree diagrams. Note that for some of the formulas, there are two presentations of the same formula, for example, there are two presentations of the direct safe harbor materials price variance. While both arrive at the same answer, students usually prefer one formula structure over the other. The following is a summary of all direct materials variances (Figure 10.66), direct labor variances (Figure 10.67), and overhead variances (Figure 10.68) presented as both formulas and tree diagrams.

Commenti recenti