Disbursement Definition, How It Works, Types, Examples

You can also create several other types of useful reports to bring clarity and insight to your business. To learn more about custom reports with Accounting Seed, see our guide to management reports and dashboards. Accounting Seed connects with applications such as ACH Connect — and has partners like Clear Cloud One that can automate cash disbursements for your business. The ACH Connect Accounting Seed Extension automates payments and subsequent Cash Receipts or Disbursements when Billing and Payable Records come due. Click here to learn more about the ACH Connect Accounting Seed Extension. If your company records more disbursals than revenues, that’s an early warning sign that your business is in financial trouble.

If the disbursements are higher than the cash inflows, a business experiences a deteriorating cash position. Federal and private student loans are generally disbursed two or more times during the academic year. The student receives a credit to pay tuition and fees and will receive any remaining balance by check or direct deposit. For example, a lender funding a personal loan likely disburses the cash directly to your checking account.

Virtual CFO: Cost-Effective CFO Solution with High Financial Expertise

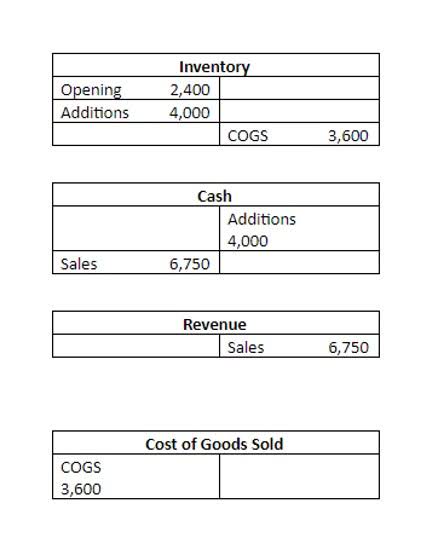

That gives them the opportunity to maximize the interest they earn on the cash in their accounts by delaying the precise time that an amount of money is debited from the account. In the world of accounting, keeping track of disbursements is essential. Bookkeepers note every outlay that a business makes, indicating the amount, the account used, the person or company receiving the funds, and the reason for the payment. They enter this information in the company’s general ledger so that the organization has a record of every transaction that it makes. Let’s say a payee invoices for an entire year at $1,600, with equal payment disbursements due quarterly.

- The institution needs to ensure accurate and timely disbursement to maintain its reputation and support student needs.

- Unlike payments, disbursals indicate the actual business activities and are helpful in making financial decisions for the future.

- You can also create several other types of useful reports to bring clarity and insight to your business.

- Meredith also spent five years as the managing editor for Money Crashers.

- A disbursement, in its most general form, is a payment that’s transferred from a payer’s account to a payee’s account.

- One reason that they continue to use checks is that checks have been used for a long time, so most businesses already have a process for making and receiving check payments.

A company manages its disbursement process by having a system in place to control payments. This typically involves receiving and reviewing invoices, getting approval for payments, and ensuring that the funds are available. Effective disbursement management also involves reconciliation processes to confirm that disbursement meaning in accounting payments are correctly recorded and accounted for. A disbursement float refers to the time difference between when a payment is made by a company and when the funds are actually deducted from the company’s bank account. During this time, the company’s bank balance reflects a higher amount than it should.

What is a Disbursement Fee?

HMRC has confirmed that VAT would not be chargeable by either the search company or the solicitor if they passed it on “without analysis or comment”. However, if the firm provides advice or makes a report on the basis of the search, HMRC’s view is that the fee will form part of the charges for its services. It was found that because the solicitors were using the information as ‘part and parcel’ of its overall service, the search fees should not be treated as disbursements. An example of reimbursement would be the cost of travel, stationery or other ‘out of pocket expenses’ added by a consultant on top of his ‘hourly consultancy fee charge’. From HMRC’s point of view, those extra costs are reimbursements and as a result VAT should be added to them as they represent costs that the business incurs itself and are not disbursements.

- The disbursement, in turn, reduces the money in the account or decreases the balance of the loan.

- All disbursements are payments, but not all payments are disbursements.

- If the loan amount exceeds the actual costs of tuition and fees, a refund of the excess is paid directly to the student.

- Business managers use these ledgers to determine and keep track of the amounts of funds disbursed.

- In business, the regular recording of all disbursements of cash is a crucial method of keeping tabs on the expenditures of the business.

Efficient management of operational disbursements is essential for good cash flow management. Cash disbursements aren’t the only repetitive accounting tasks you can automate. Accounting Seed users can also create custom management reports with custom rows and columns detailing cash disbursements by batch.

Commenti recenti