Basic Earnings Per share Basic EPS Formula, Calculation

But the outstanding options — whether in the money or not — do not affect diluted share count. Again, they are anti-dilutive; if they were added to the diluted share count, loss per share would improve slightly, to $0.95. The valuation metric price to earnings ratio uses EPS as its main component.

A Variable in the Price/Earning Ratio

First, let us look at the calculation of the basic EPS of Starbucks and its interpretation. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. The net dilution equals the gross new shares in each get your second stimulus check 2020 tranche less the shares repurchased. Bank of America (BAC), for example, is in the financial services sector. Investors can compare the EPS of Bank of America with other financial institutions, such as JP Morgan Chase (JPM) or Wells Fargo (WFC), to get an idea of relative financial strength.

Create a Free Account and Ask Any Financial Question

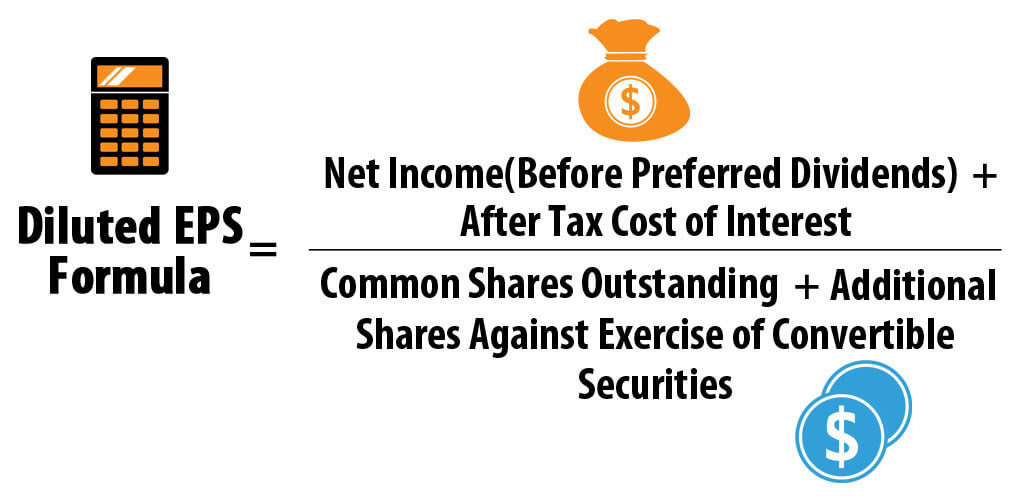

Just as a share price on its own doesn’t make a stock price ‘cheap’ or ‘expensive’, earnings per share on its own doesn’t prove fundamental value. And so diluted share count equals 10 million shares plus another 500,000 (the 1 million shares underlying options, less than 500,000 theoretically repurchased). Diluted EPS is calculated by dividing the $10 million in net profit by the 10.5 million in diluted shares, giving a result of 95 cents. In that case, the options are excluded because they would increase the diluted share count — and thus actually decrease the loss per share.

What is the difference between pro forma and reported earnings per share?

Common shares are types of stocks that show partial ownership in a company. In other words, somebody who owns one or more common shares is part-owner of the corporation which issued those shares. It includes not only those shares already issued, but those that likely will be in the future.

What is the meaning of EPS growth?

Earnings per share detail a company’s progress during one year and is an important benchmark for investors when judging risk. Making a comparison of the P/E ratio within an industry group can be helpful, though in unexpected ways. Although it seems like a stock that costs more relative to its EPS when compared to peers might be “overvalued,” the opposite tends to be the rule. If you have an interest in stock trading or investing, your next step is to choose a broker that works for your investment style.

- The valuation metric price to earnings ratio uses EPS as its main component.

- But, you need to know that the additional shares that can become outstanding will also be included as common stock.

- If it loses $10 million with 10 million shares outstanding, basic loss per share is $1.00 even.

- The core reason is that share counts can be extraordinarily different.

Basic earnings per share are most accurate when calculating for companies with uncomplicated financial structures or that only have common shares. As the name suggests, convertible preferred shares can be transformed into common shares if the shareholder desires. If a shareholder is not paid on time, preferred shares allow for that person to still receive their full dividend payment, including any missed or previous payments.

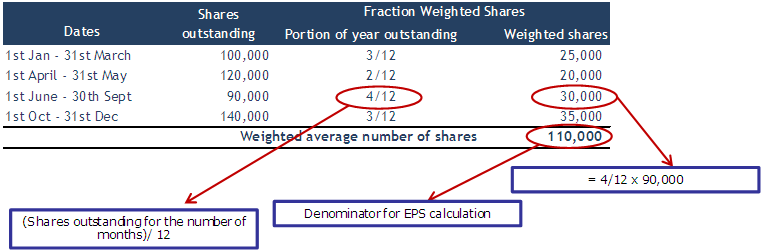

A more refined calculation adjusts the numerator and denominator for shares that could be created through options, convertible debt, or warrants. The numerator of the equation is also more relevant if it is adjusted for continuing operations. Earnings per share, or EPS, is a ratio that divides a company’s earnings by the number of shares outstanding to evaluate profitability and gain a pulse of the company’s financial health. ABC also has 1 million stock options outstanding with an exercise price of $10, while its stock trades at $20.

The share price of a stock may look cheap, fairly valued or expensive, depending on whether you look at historical earnings or estimated future earnings. Regardless of its historical EPS, investors are willing to pay more for a stock if it is expected to grow or outperform its peers. In a bull market, it is normal for the stocks with the highest P/E ratios in a stock index to outperform the average of the other stocks in the index. Shareholders might be misled if the windfall is included in the numerator of the EPS equation, so it is excluded. Sometimes an adjustment to the numerator is required when calculating a fully diluted EPS. For example, sometimes a lender will provide a loan that allows them to convert the debt into shares under certain conditions.

Stock price movement is the most significant indicator of future performance. Cash earnings per share are calculated by dividing a firm’s operating cash flow by diluted shares outstanding. It is often reported on a basic and diluted basis, which takes into account the impact of dilutive securities such as stock options and convertible debt. Whether basic or diluted EPS is better depends on the purpose of the evaluation. Basic EPS provides a conservative measure by assuming no potential dilution from convertible securities. On the other hand, diluted EPS accounts for the potential dilution of outstanding shares.

Commenti recenti