What is a contract size forex?

However, trading leveraged products like E-Mini S&P 500 futures also involves the risk that losses can exceed the amount originally invested and may not be suitable for all investors. E-mini S&P 500 futures are traded on the Chicago Mercantile Exchange (CME) and allow traders to gain exposure to the S&P 500 index, a widely recognized barometer of the U.S. stock market. Representing one-fifth of the standard S&P 500 futures contract, E-mini S&P 500 futures make https://trading-market.org/fundamental-analysis-definition/ futures trading more accessible to more traders, and have been a success ever since their introduction in 1997. More recently, Micro E-mini S&P 500 futures have been introduced. Though there are now several E-mini contracts available across a variety of indexes, E-mini S&P 500 futures still account for the vast majority of all U.S. stock index futures trading. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Almost all currency futures — except some e-micro futures and some lesser volume contracts — use the USD as the quote currency, which are called American quotations. The minimum change in value of a futures contract is the tick, equal to the contract size multiplied by the pip value of the currency. Price changes in currency futures are calculated by multiplying the number of ticks by a constant multiplier, which is what a tick is worth in USD. The actual value of a tick will depend on the specific type of contract.

EURAUDEuro/Australian Dollar

For an instance, the contract size of gold futures contract is 100 ounces (on COMEX), so move of $1 in the price of gold translates into $100 change in the value of gold futures contract. The fact that contracts are standardized to specify contract size can be a benefit as well as a drawback for traders. It works by offsetting a loss in an asset by taking an opposite position in another related asset.

- Think of your broker as a bank who basically fronts you $100,000 to buy currencies.

- This is also a good way to start planning your trading strategies, as you’ll get in the habit of keeping each Start and Close time in mind.

- Once a margin call is issued, then the margin must be brought back up to the initial margin requirement, not the maintenance requirement.

A contract size refers to the amount of the underlying asset that is traded in a single transaction. In the forex market, the underlying asset is a currency pair, and the contract size represents the amount of currency being traded. The contract size is typically measured in lots, with one lot being equivalent to 100,000 units of the base currency. The forex market is an ever-evolving financial market that sees trillions of dollars traded every day.

Aussie and Canadian Futures

The trading unit for weather futures contracts is $20.00 times the cooling degree day index, regardless of the location. While all contract units are standard for a particular commodity, it may vary within a class of commodities. For example, the contract size for gold https://currency-trading.org/education/5-best-free-stock-screeners-for-2021/ is 100 troy ounces, while the contract size for high grade copper is 25,000 pounds. The contract size is also important when it comes to margin requirements. Margin is the amount of money a trader must deposit with their broker to open and maintain a position.

This value not only defines the deliverable quantity, but is directly related to the dollar value of the transaction. While the deliverable quantity may vary with the underlying asset, there is a standard for each asset type. For example, the contract size for an equity option is 100 shares of stock. A CFD is a short-term contractual agreement between a trader and a seller (e.g. an investment bank, a brokerage, or a spread betting firm). When the buyer wants to end the contract, both parties exchange the difference between the opening and the closing prices of the specific asset. With CFD trading, you can either make a profit or a loss, depending on what direction your selected assets end up moving in.

History of commodity markets – FOREX.com

History of commodity markets.

Posted: Thu, 22 Jun 2023 07:00:00 GMT [source]

The amount of leverage you use will depend on your broker and what you feel comfortable with. Think of your broker as a bank who basically fronts you $100,000 to buy currencies. You are probably wondering how a small investor like yourself can https://day-trading.info/fxcc-com-cyprus-based-forex-trading-broker-review/ trade such large amounts of money. The company is comprised of four Designated Contract Markets (DCMs). Further information on each exchange’s rules and product listings can be found by clicking on the links to CME, CBOT, NYMEX and COMEX.

A Beginner’s Guide to Contract for Differences (CFDs)

Traders in this business must have basic skills and knowledge about the movement of market, different tools, and criterions in order to be successful in the forex trading. In this context, forex contract size is also one of the most crucial components for successful trading experience in forex. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries.

70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The contract size is an important variable to understand when entering into an options or futures contract.

EURJPY Specifications

It can be simplified as a process of buying and selling money at the same time. So in the case of the gold contract, each $1 move in the price of gold translates into a $100 change in the value of the gold futures contract. Once you know which strategies work best for you, you can enter the real market and start trading with a live account. At Blueberry Markets, we offer reliable sources in our digital library to learn more about CFDs and a dedicated account manager who can assist you in mitigating risk strategies. With CFD trading, you can speculate on asset prices without really owning them. This gives you a chance to maximise profits with price speculations and avoid extra handling fees.

- Brokers will often adjust margin requirements, depending on market conditions.

- If you choose to buy Apple’s CFDs, you can trade by purchasing 100 CFDs at the price of $800.

- Because margin is increased or decreased daily, according to the account value, this margin is called variation margin.

This means that for every $100,000 traded, the broker wants $1,000 as a deposit on the position. When you place orders on your trading platform, orders are placed in sizes quoted in lots. This is a type of derivatives contract that gives the buyer of the contract the right, but not the obligation, to buy or sell an underlying asset at a specified price within a specific time period. It is said that forex contact is actually the result of concurrent purchase of any one specific currency along with sale of other.

The exchange specifies when delivery will occur within the month and when a given contract initiates and terminates trading. Typically, trading for a contract is halted a few days before the specified delivery date. Each and every standard lot traded in the forex market is equivalent to 100,000.

For instance, a derivative transaction can occur directly between banks in a practice called over-the-counter (OTC) trading rather than through a regulated exchange. Emerging markets pairs are either quoted based on the spot market (Spot FX) or one-month non-deliverable forward prices (EMFX). Spot FX contracts are priced in the pair’s second named currency, but EMFX contracts are only priced in US dollars. Some futures contracts, such as the yen and the Canadian dollar, are quoted inversely to the way they are generally expressed in forex.

Currency Futures Contracts

None of the information featured on this website and pertaining to financial market services is aimed at Russian residents. This website does not encourage Russian citizens to engage in any trading activity. When you trade in a currency other than your default currency, your profit or loss will be realized in that currency.

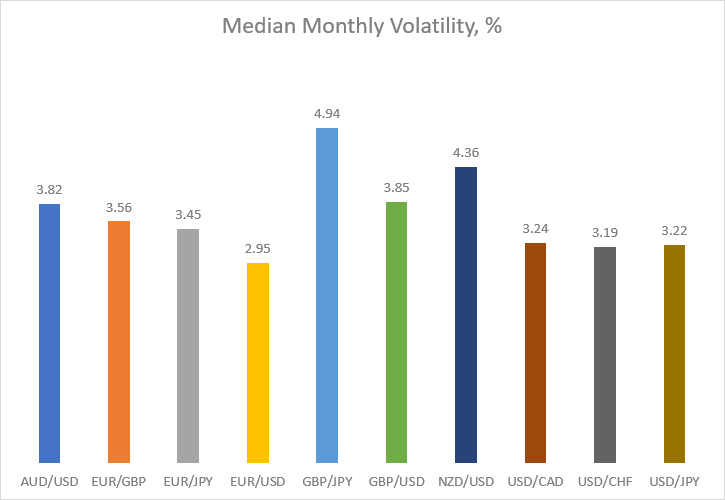

As standard practice, we will then immediately convert this back to your default currency. Futures on the major currencies generally have a contract size of 125,000 units and a tick value of $12.50. For instance, the British pound has a standard contract size of 62,500 units, so the tick value and multiplier are $6.25. Its value depends on an underlying benchmark, asset, or a group of assets, They are set between two parties who use them to trade different securities and access various markets. Contract values are based on price fluctuations of the underlying security.

Commenti recenti